The global 3D printer market trend exhibited sharply contrasting performance across different market segments during the second quarter of 2025, according to the latest analysis from CONTEXT, a leading market intelligence firm. Whilst the consumer-focused entry-level sector continued its impressive expansion, the industrial segment remained mired in challenges stemming from reduced capital expenditures and ongoing industry consolidation. These divergent 3D printer market trends highlight a fundamental shift in how different sectors are adapting to current economic conditions, with high interest rates and tariff uncertainties creating persistent headwinds for premium equipment purchases.

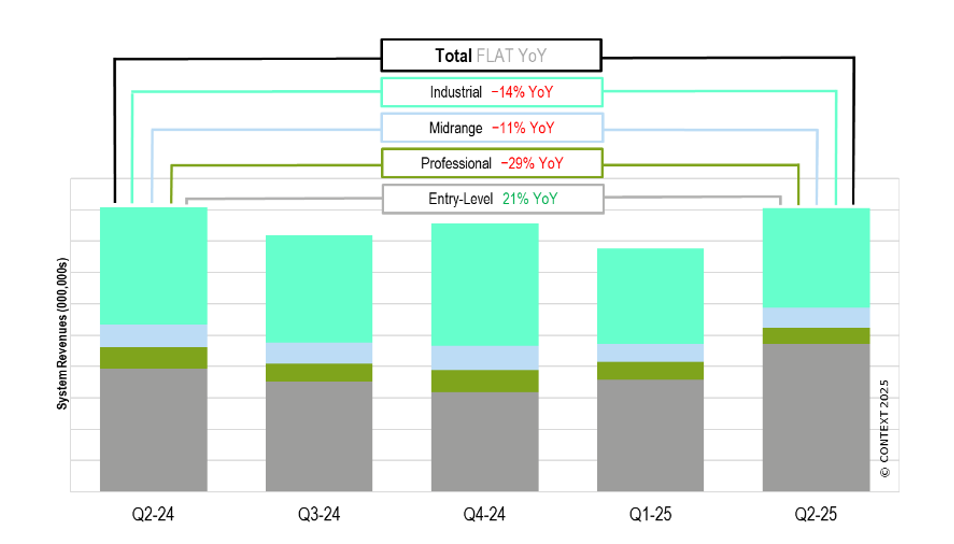

Released on 9th October 2025, the quarterly analysis reveals that overall aggregate hardware system revenues remained flat year-on-year despite the entry-level segment’s remarkable 21% revenue surge. This growth, driven primarily by strong performance from manufacturers such as Bambu Lab, was completely offset by substantial declines across professional, midrange, and industrial categories, which experienced revenue drops of 29%, 11%, and 14% respectively.

Global 3D Printer Market trends

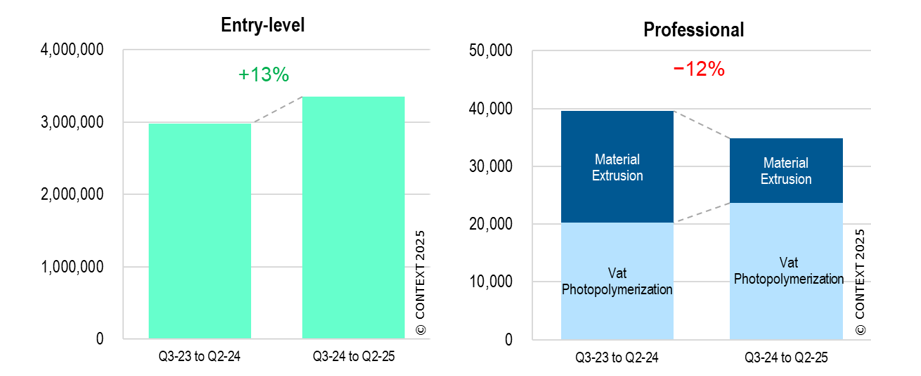

Entry-Level & Professional Segment

The entry-level category, encompassing printers priced below $2,500, emerged as the standout performer with robust year-on-year shipment growth throughout Q2 2025. Bambu Lab continued its dominant trajectory with rising shipments and new product introductions, whilst the segment witnessed significant milestone events including Creality’s announcement of plans for a public listing. Although Creality experienced temporary shipment declines during its IPO preparation and reporting realignment, the move signals growing financial maturity within the consumer market.

Consumer enthusiasm remained strong, exemplified by Snapmaker’s record-breaking crowdfunding campaign for its new multi-colour FDM printer. This sustained momentum demonstrates that accessible price points and improving capabilities continue attracting makers, hobbyists, and small businesses despite broader economic uncertainties.

The professional segment, covering printers priced between $2,500 and $20,000, recorded significant year-on-year shipment declines driven entirely by material extrusion technology collapse. FDM/FFF shipments cratered as capable, lower-priced entry-level machines increasingly displaced traditional professional-grade equipment. Conversely, vat photopolymerisation shipments remained steady, with manufacturers like Formlabs successfully refreshing key product lines.

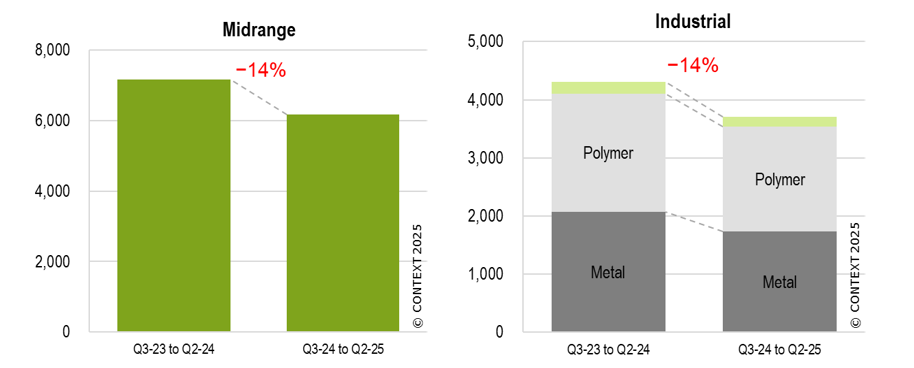

Industrial and Midrange Segment

Current 3D printer market trends reveal that high-end segments continue struggling with challenging conditions. Global industrial 3D printer shipments, representing systems priced above $100,000, fell markedly during Q2 2025. The quarter was complicated by significant industry disruptions, including Desktop Metal’s bankruptcy and complex mergers such as Nano Dimension’s integration with Markforged and Desktop Metal, which saw collective shipments decline precipitously year-on-year.

However, selective bright spots emerged within the industrial category. HP demonstrated impressive shipment growth through its strategic upgrade programme, whilst Stratasys posted notable gains. Within the critical metal powder bed fusion segment, China’s Eplus3D captured the top position for units shipped and joined Velo3D in achieving year-on-year shipment growth. Established leaders EOS and Nikon maintained their revenue dominance despite experiencing marginal unit shipment declines.

The midrange category, spanning $20,000 to $100,000, mirrored industrial segment difficulties with similar year-on-year shipment declines. Western manufacturers including 3D Systems and Stratasys experienced the most pronounced downturns, whilst some Chinese vendors like UnionTech achieved shipment growth fuelled by domestic demand. Flashforge, despite strong trailing-twelve-month performance, recorded a modest quarterly shipment dip.

Market Outlook and Recovery Projections

Persistent headwinds from elevated interest rates, tariff uncertainties, and inflation are expected to continue suppressing capital expenditures for premium systems throughout the remainder of 2025. Whilst the US Federal Reserve initiated interest rate cuts in September 2025 with additional reductions anticipated before year-end, substantial recovery likely requires multiple rate adjustments before capital spending fully restimulates.

Despite many manufacturers reporting strong end-market engagement and accumulated demand, significant industrial segment rebound projections have shifted to 2026, when lower interest rates should finally unlock renewed investment in capital equipment. Regional on-shoring initiatives and supply chain disruption solutions present substantial opportunities for agile additive manufacturing once business conditions improve.

About Manufactur3D Magazine: Manufactur3D is an online magazine on 3D Printing. Visit our Global News page for more updates on Global 3D Printing News. To stay up-to-date about the latest happenings in the 3D printing world, like us on Facebook or follow us on LinkedIn and Twitter. Follow us on Google News.